Innovation is difficult to measure. As a result, decision-makers must instead rely on a series of proxy metrics to provide a picture of a firm’s or country’s innovation performance. One of the most commonly used measures is patent data, particularly patent applications and grants. Both here at the DEEP Centre and elsewhere, patent statistics have informed a conversation about Canada’s lagging performance. As a result, some governments have opted to create policies – such as the patent box that Dan wrote about last month, which provides preferential tax treatment for income derived from intellectual property – in an effort to encourage more patenting activity.

But what do patent applications really tell us? What does the number of patent applications and grants reveal and, equally, what does it obscure?

The relationship is not as straightforward as many accounts suggest. While patents remain one important indicator of innovation output, policymakers and business leaders must be wary of relying too heavily on this metric to gauge innovation performance. While patent counts do have a place in measuring innovation, policymakers need to consider these measures carefully and in the context of other metrics. We’re about to release a more comprehensive report on a variety of innovation indicators, patents being one. Until then, here’s a short primer.

Patent Applications and Grants as a Measure of Innovation

Examining domestic patenting activity through the Canadian Intellectual Property Office, for example, a recent paper by the C.D. Howe Institute argues that “patent applications are a good measure of the innovative spirit in a country.” The report went on to argue that patents

…have several advantages as a measure of innovation. Most obviously, they represent a direct outcome of the research process, rather than an input, like R&D spending. They also provide considerable information on the invention, allowing better understanding of the quantity and quality of innovation, and potentially its allocation by location or sector, over a significant period of time.

Patents, then, are often taken as the concrete manifestation of innovation, and have significant advantages in terms of measurability. At the same time, patents are assumed to provide an incentive for innovation by allowing an inventor to capture the rewards of her or his intellectual output and to disclose their invention to allow for use and further innovation.

Are either of these assumptions true?

Setting aside the fact that the majority of patents are not commercialized, one of the most notable recent developments in this debate is illustrated by the Tabarrok curve, which suggests that, at the societal level, strong patent protection is useful for innovation, but more is not better. Rather, Tabarrok points out that the relationship between innovation and patent strength is marked by diminishing, and past a certain point, negative, returns. This is because, while some patent protection serves as an incentive to innovators, too much results in legal gridlock and balooning costs of litigation that act as a disincentive to innovative activity. This curve appears well suited to describe the situation with respect to US software patents in particular. At the same time, growth in patents may be a marker of patent inflation – that is, growth in the number of patents as a result of declining evaluation standards – rather than reflecting underlying processes of innovation.

Others scholars in the field have considered how patents compare to other indicators of innovation, particularly research and development expenditure and factor productivity. Examining the United States, Michele Boldrin and David Levine, writing in the Journal of Economic Perspectives, note that “the recent explosion of patents (in the US)….has not brought about any additional surge in useful innovations and aggregate productivity.”

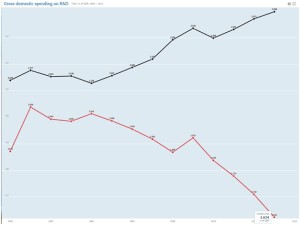

Looking at the Canadian case, some de-linking between patents and other innovation metrics does appear evident. While the number of patent grants and patents in force has grown in recent years, Canada’s gross expenditure on research and development (GERD) has continued to decline, both in comparison to the broader OECD average and as a share of gross domestic product (GDP). Canada’s recent performance on this metric as compared to the OECD average is shown on the chart below. Over roughly the same period, Canada has also witnessed lagging productivity performance.

Evidently, none of the preceding should be taken as an indication that patents should be discarded as a measure of innovation performance. In light of the difficulty of measuring innovation and the paucity of available data, patents will remain important within broader discussions of economic policy. Nevertheless, caution is warranted on two fronts.

First, in evaluating Canada’s innovation performance, policymakers must remain conscious of multiple – and occasionally conflicting – metrics. An upcoming DEEP Centre Paper and info-graphic authored by our data specialist Kirill Savine aims to do just that. Second, policy-makers and business leaders must be wary of policies that seek to promote growth in patents, rather than the underlying process of innovation they are intended to reflect and incentivize.