Rankings of top innovators should necessarily be taken with a grain of salt. They privilege scale as opposed to disruption and given the lack of standardized methodology, they’re hardly comparable. That said it’s worth pondering why Canada can’t seem to place any post-BlackBerry companies on these lists.

Take two recent ones – the Thompson Reuters top 100 innovators list released in November, and the December 2015 BCG Most Innovative Companies index. On the former, just one Canadian company makes the cut, BlackBerry. On the more recent BCG release, none qualify.

What gives?

On one hand, maybe this should be expected. As we’ve written repeatedly, business spending on R&D in Canada is on a depressing downward trend. This is well documented just about everywhere. How can you compete if you don’t invest?

But this aggregate data hides a lot of nuance. I’ve been digging into the numbers on corporate R&D through a couple of different lenses, and some of the stories that emerge are quite interesting (but still depressing).

Take for example, what we might define as “top innovators” as noted on the aforementioned lists. You’d assume those represent the top R&D spenders in any jurisdiction. In Canada, those top spenders are actually the biggest culprits in our declining BERD.

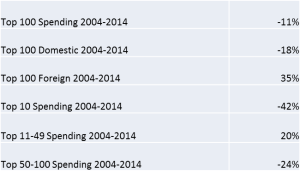

I’ll use the list of the top 100 R&D spenders in Canada as compiled annually by ResearchMoney. I’ve taken their 2004 and 2014 data, adjusted the latter for inflation, and come up with the following cohort analysis:

It’s actually Canada’s largest spenders that have decreased their shares of investment most significantly. And it’s domestic rather than foreign subsidiaries that are the primary contributors to this trend.

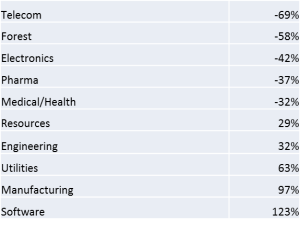

Breaking this down by sector, we find some interesting trends.[1] While seeing software’s contribution rise isn’t a surprise, that manufacturing firms are spending more amongst this top 100 cohort is. Perhaps more interesting, however, are the significant declines in spending over this period in telecom and electronics.

In both cases, the decline in spending is the result of the disappearance or significant decline in investment by just a couple of key companies. In telecom: Nortel and Bell Canada. In electronics, the decline is largely attributable to the halving of investment in what is now AMD Canada (formerly Markham-based ATI Technologies acquired in 2006 by Sunnyvale-based AMD).

Unfortunately, their declines are just the tip of the iceberg. First, no one has stepped up to replace them in the top 10. And perhaps more impactful, the positive growth seen in spending amongst firms ranked 11-49 equals 2% spending growth a year. And amongst the next tranche of companies, a net decline of 2.4% a year.

To be sure, there are glimmers of hope, the growth in software spending (buoyed primarily by BlackBerry….) and decent spending in manufacturing amongst them. However on a whole, we haven’t replaced our previous champions in investment and spending in key areas such as telecom and electronics, and haven’t seen significant numbers of aggressive (top 100, so large) newcomers in software. In my next post, I’ll go further into the data on investment by company size that highlights that while startups are playing their part, mid-range co’s are falling flat.

[1] Caveat – some of the sector classification are a bit teneous – the overall picture still holds though.