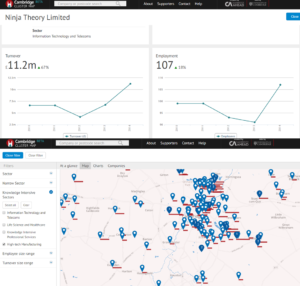

Last fall I spent some time in London (UK) with Charles Armstrong, the founder of Trampoline Systems and the creator of Cambridge Cluster Maps (CCM). CCM holds revenue and employment data on over 20,000 Cambridge businesses, both publicly traded and privately held. This effort benefits from UK regulations on private enterprises that mandates annual reporting for all firms with more than 50 employees. This reporting requirement means annual revenue and employee numbers are made public. For those below the 50 employee threshold, the CCM uses a variety of means to scrape together this data, including voluntary reporting by local startups.

The result is a useful tool for identifying fast growing (or decelerating) companies and sectors, as well as the geographic areas that firms are clustering around. As Armstrong noted in our discussion, the data that underpins this system exists because of “a culture of data and transparency.” He goes on to add that the

system “provides the means for better understanding growth,

clusters and the policies that can be implemented to target them.”

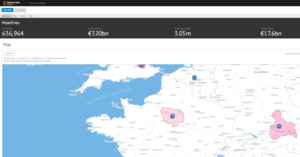

Armstrong`s efforts in the UK have quickly gained traction and he`s now providing the infrastructure for StartupHubs.EU, a pan-European effort through the European Commission to bring this level of insight across Europe. The result is the aggregation of data on over 600,000 companies, obtained through national registries as well as via Crun chbase, Angel List and other platforms. This effort will eventually provide the basis for allowing for consistent evaluation across ecosystems, and then to identify and adopt best practice policy for startup and scaleup support.

The result of both of these examples is a pretty accurate picture of economic activity at a variety of levels of analysis. The value that accrues to policy makers, and potentially to other firms seeking potential suppliers, customers or investors, is significant. In particular, as policy efforts increasingly focus of `surgical interventions` that target leading firms in an effort to help them scale (rather than broad, spread the peanut butter approaches), having access to this type of data, and to the benchmarks it provides, is key.

Alas, in Canada we`re a long way from having a similar setup. We don’t have the disclosure requirements that underpin these systems and, so far, we haven’t seen any effort to build a voluntary system. Could we? It’s hard to tell whether appetite exists amongst firms to do so. Would a transparent database on private firm performance support or undermine growth? Would it give too much power to potential buyers? These questions/risks notwithstanding, it’s certainly worth thinking through whether there aren’t ways to alleviate such concerns by anonymizing data for public use. The potential benefits via targeting efforts are too big to not think this through.