Ontario’s recent Fall Economic Statement delivered by Finance Minister Charles Sousa includes two proposed research and development (R&D) incentives meant to convince firms to invest idle cash into research and technology.

In so doing, Sousa is trying to boost business expenditure on R&D (BERD), a measure by which Ontario, and more broadly, Canadian firms do relatively poorly. This poor BERD-performance is largely used to signal a major impediment in the development of Canada’s innovation economy and our overall competitiveness.

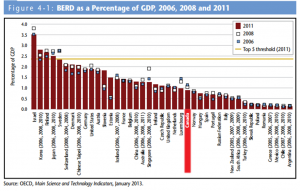

While Canada ranks highly in terms of government support for R&D, private investment lags behind our competitors significantly. In 2011, BERD spending in Canada was .89% of GDP, half of the US figure and about a third of Finland, Sweden, Israel, Japan and South Korea.

More broadly, as the 2012 State of the Nation on Canada’s Science and Technology Strategy report highlights… “Canada’s performance is particularly poor on measures of business enterprise expenditures on research and development (BERD) – that is, the R&D performed by firms. Although preliminary data suggest that BERD in Canada increased very slightly in both 2011 and 2012, BERD intensity (BERD as a percentage of GDP) has been in almost continuous decline for over the past decade. Canada’s rank among comparator countries on BERD-to-GDP fell to 25th in 2011 (of 41 countries).”

Addressing Canada’s weakness with regards to BERD has led some provinces, notably Ontario, to try and tweak the provincial incentives developed to address this.

Ontario’s proposed approach would see two new incentives developed. The first would see the introduction of “pay or play” tax incentives that would see special corporate taxes or payroll taxes levied on firms that could be “eliminated or reduced through investments in new equipment or other eligible investment expenses” and/or “investments in employee training and/or by funding training programs.”Ontario Finance Minister Charles Sousa notes that “If those companies don’t initiate those investments, don’t provide for those supports, then they pay what they’re paying now. If they do other things, if they play, they get a better rate.

A second proposed lever is to direct R&D credits towards incremental spending on research, rather than nominal annual figures.

In both cases, the argument is made that since other jurisdictions have moved forward with some reforms, Ontario could and should follow as a means of encouraging business R&D. And on the surface of it, such moves towards inter-jurisdictional competitiveness should be applauded, notably as the Canadian dollar deflates leaving investment in capital and technology more costly. A review of the evidence on the effectiveness of R&D incentives shows a positive relationship between R&D credits and BERD investment. The most oft-cited research is by Bloom, Rennen and Griffiths (2002). They estimate that a 10% decline in the cost of R&D “stimulates just over a 1% rise in the level of R&D in the short-run, and just under a 10% rise in R&D in the long-run.” A more recent review of R&D tax credits by the UK government shows a more mixed result, noting that “for every pound of public subsidy, private spending increases by between 40p and over £3.”

Putting more public dollars into R&D credit schemes would seem to be backed by a certain amount of evidence. That said, the proposed changes have little to no detail attached to them so it’s difficult to ascertain exactly how the proposed moves would affect BERD. As a result, and for the sake of discussion, one might question whether this is the most effective means of channeling foregone tax revenue ?

In particular, while tax credits are attractive to profitable, cash rich firms, notably large ones, the literature on firm growth indicates that our policy efforts should be focused on helping SMEs grow. Subsequently, chanelling tax revenue into rebates might not actually create as much long-term impact on the economy as would tax policy reforms geared specifically towards SMEs and startups.

Here, two policy options would seem preferable. First, a refundable SME tax credit for R&D would allow cash-starved startups and SMEs to use rebates as a supplement for much needed early-stage capital, even when unprofitable.

Similarly, tradeable tax credits as have been introduced in New Jersey and Pennsylvania allow firms to trade or sell their non-useable tax credits to firms looking to reduce their tax expenditures. In the two states mentioned, credits are specifically used to incent R&D activity in the biotechnology sector. And in both cases, the state sets a floor at which the credits can be sold. Once again, the goal is to stimulate SME growth via infusions of necessary capital. This latter option is possibly the most aligned with Ontario’s goal for it both drives capital to SMEs, and incents larger, tax-paying firms to spend their cash.

Ultimately, while Ontario’s “pay or play” R&D incentives are a laudable attempt to solve a real issue related to a lack of business investment, there are other options on the table that may be more effective at unlocking economic and employment growth in Ontario. Given how limited the provincial bank account is, choosing wisely with scarce dollars is of the essence.