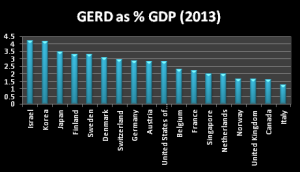

Here at the DEEP Centre blog we’ve frequently bemoaned Canada’s poor performance on research and development spending (R&D). Canada’s gross spending on R&D currently hovers around 1.6% of GDP, putting us well behind our peers in many other OECD countries.

At the same time, many in Canada have been debating whether Canada suffers from an innovation or commercialization deficit. While intimately connected, these twin problems tend to suggest different types of solutions. An innovation deficit highlights a lack of sufficient technology development and points to the need for Canada to double-down on technical training and R&D. Conversely, the presence of a commercialization deficit would suggest that Canada’s problem is not the lack path-breaking new technologies, but rather a series of mostly business-related barriers that prevent firms and technologies from successfully transitioning from the lab to the marketplace. Popular commentaries increasingly emphasize the commercialization challenge, hinting that issues related to Canada’s intellectual property rights regime and access to high-level management talent are stifling the emergence of the next wave of Canadian technology champions. According to this line of reasoning, Canada has a great pool of engineering and design talent and, as such, our problems likely lie on the business and marketing side of the ledger.

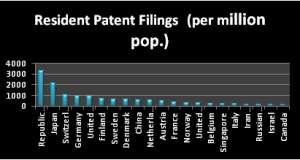

But while commercialization is undoubtedly an issue for Canadian firms, Canada’s problems also seem to stem from lack of technological innovation, driven by poor performance in R&D and rough innovation ‘output’ metrics, such as patent applications. As the chart below highlights, our poor performance in R&D is paralleled by low numbers of patent applications, measured here per 100 million residents.

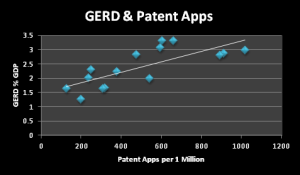

Some have suggested that low numbers of patent applications point to a commercialization problem. Specifically, these accounts suggest that Canadian innovators have great invention, but are failing to adequately protect and market them. But is commercialization the core problem here? Perhaps not. While all the usual caveats for this type of back-of-the napkin analysis necessarily apply, in the broadest terms countries that do more R&D tend to generate more patent applications than those who spend less. And while the relationship is not perfect, it suggests that there could be real output benefits from boosting Canada’s gross R&D spending.

The Swedish Counterfactual

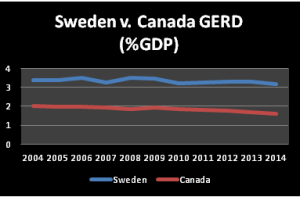

Debates about Canada’s commercialization problem to a large extent mirror those in other countries. In this context, Sweden is a country wrestling with what looks like a commercialization gap. Compared to Canada, Sweden has high levels of gross R&D – over 3% of GDP – and more than four times the number of patent applications per million residents. Business R&D spending is also strong (2.2% of GDP) despite minimal government supports and a lack of any innovation or R&D tax credit. Nevertheless, Sweden suffers to some extent from a failure to fully realize the value of their technology development infrastructure. If Sweden is an ideal case of a true ‘commercialization deficit,’ Canada’s comparative outputs suggest that our problems lie more in R&D.

In reality of course, both innovation and commercialization issues are closely inter-related. Failure to commercialize existing technologies means fewer resources available to devote to future R&D efforts. And as Kirill pointed out in his Innovation Scorecard, Canada’s business R&D is less productive in producing patents per-dollar than the OECD average. On this basis, it is clear that Canada has both innovation and commercialization challenges that need to be addressed.